YOU CAN SUPPORT US FROM WHEREVER YOU ARE!

Your donations are tax deductable in Switzerland and elsewhere, in line with the current laws of your country of residence. One more reason to support our cause.

INDIVIDUALS

SWITZERLAND

Your donations are tax deductible in line with the fiscal regulations of your canton.

FRANCE

You can obtain a tax reduction of 66% of the amount of your donation which can be up to 20% of your taxable income. If you are subject to real estate wealth taxation (IFI in French), you benefit from a reduction on this tax of 75% of the amount of your donation, up to a limit of 50,000 euros. It is important to note that the proportion of the donation which allows a reduction of the real esate wealth tax (IFI) does not entitle you to a parallel reduction of your income tax (IR, impôts sur le revenu). Where there is eligibility for both of these schemes, the donor can choose one or the other, or to allocate their donation as they see fit.

COMPANIES

SWITZERLAND

As a company in Switzerland, your donations are tax dedcutible in line with the fiscal regulations of your canton.

FRANCE

All payments made to the ADED association entitle you to a corporation tax reduction equivalent to 60% of the amount of such payments, up to a limit of 20,000 euros or 5 euros for every thousand euros within the pre-tax turnover figures of the company. Where this ceiling is exceeded, the surplus can be carried over onto the next five tax years.

For those of our donors living in France, we offer the opportunity to make a donation via La Fondation de France (The French Foundation). This option means you can support our cause in an effective and transparent way, while simultaneously benefitting from the fiscal arrangements within existing French legislation. We are grateful for your support and recommend you use this method to make your donation to help our association.

Bank Payment

If you would like to make a donation to the ADED association, simply transfer the amount by bank payment into the following account :

Postfinance

IBAN: CH38 0900 0000 1215 3629 1

Swift/BIC: POFICHBEXXX

For the attention of :

ADED (Association de Développement Durable)

Chemin des Sports 80 – 1203 Genève

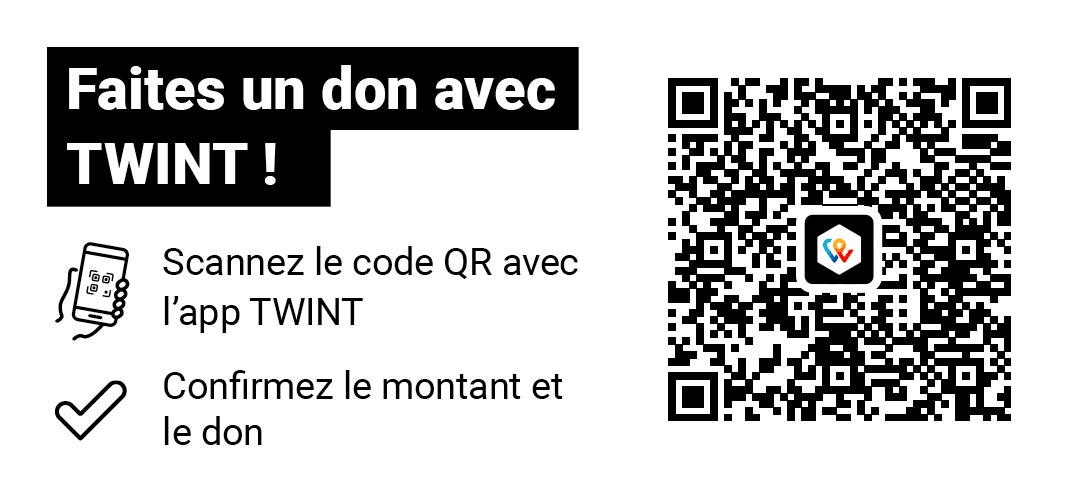

Payment by Twint

(only in Switzerland)

You also have the option to directly scan the QR code in order to make your payment via Twint. However, we recommend you prioritise a bank payment if possible in order to avoid the commission charges which Twint will make.